oregon statewide transit tax form 2020

Do not return the form with blank fields. Use Fill to complete blank online OREGON pdf forms for free.

How To Transfer Your Oregon Transit Tax Information From Sage 100 To The State

2022 Form OR-STT-1 Oregon Quarterly Statewide Transit Tax Withholding Return Office use only Page 1 of 1 150-206-003 Rev.

. The Oregon transit tax is a statewide payroll tax that employers withhold from employee wages. 01 Date received Payment received Submit. Blank fields do not qualify as a.

If you had no payroll during this quarter enter 0. Office use only Page 1 of 1 150-101-071. Beginning in tax year 2020 the Department will add the statewide transit tax program to Form OR-OTC-V Oregon Combined Payroll Tax Payment Coupon and discontinue use of Form.

Oregon Quarterly Statewide Transit Tax Withholding Return Office use only Page 1 of 1 150-206-003 Rev. Oregon Department of Revenue 19120001010000 Form OR-STT-2 Statewide Transit Tax Employee Detail Report Office use only Page 1 of 1 150-206-006 Rev. All forms are printable and downloadable.

File and pay the tax due by. Form OR-40 Oregon Individual Income Tax Return for Full-year Residents Instructions. Get 2020 form or STT 1 Oregon quarterly statewide transit tax withholding return 150 206 003 signed right from your smartphone using these six tips.

The new statewide transit taxpart of House Bill HB 2017 from the 2017 Legislative Sessiontakes effect on July 1 2018. Once completed you can sign your fillable form or send for signing. 01 Date received Payment received Submit original formdo.

Beginning in tax year 2020 the Department will add the statewide transit tax program to Form OR-OTC-V Oregon Combined Payroll Tax Payment Coupon and. Corporate Activity Tax training materials. Form OR-40-N and Form OR-40-P Instructions Oregon Individual.

HB 2017 requires all employers to withhold report and. 2019 Form OR-STI Oregon Statewide Transit Individual Tax Return Submit original formdo not submit photocopy. All Oregon employers who have an income tax withholding and statewide transit tax account open with the Oregon Department of Revenue must file Form OR-WR Oregon.

Page 1 of 1 150-206-001-1 Rev. Enter total Oregon statewide transit tax withheld. Corporation Business and Fiduciary e-filing.

Corporation excise and income tax filing information and requirements. 6-25-20 Orego eae of Revee o R-- o Form OR-STT-A Oregon Annual Statewide Transit Tax Withholding Return Instructions General information. Oregon Annual Reconciliation Form OR-WR Starting with tax year 2019 businesses and payroll service providers will be required to file the Oregon Annual Reconciliation electronically.

Oregon employers must withhold 010 0001 from each employees gross. Corporation estimated excise or.

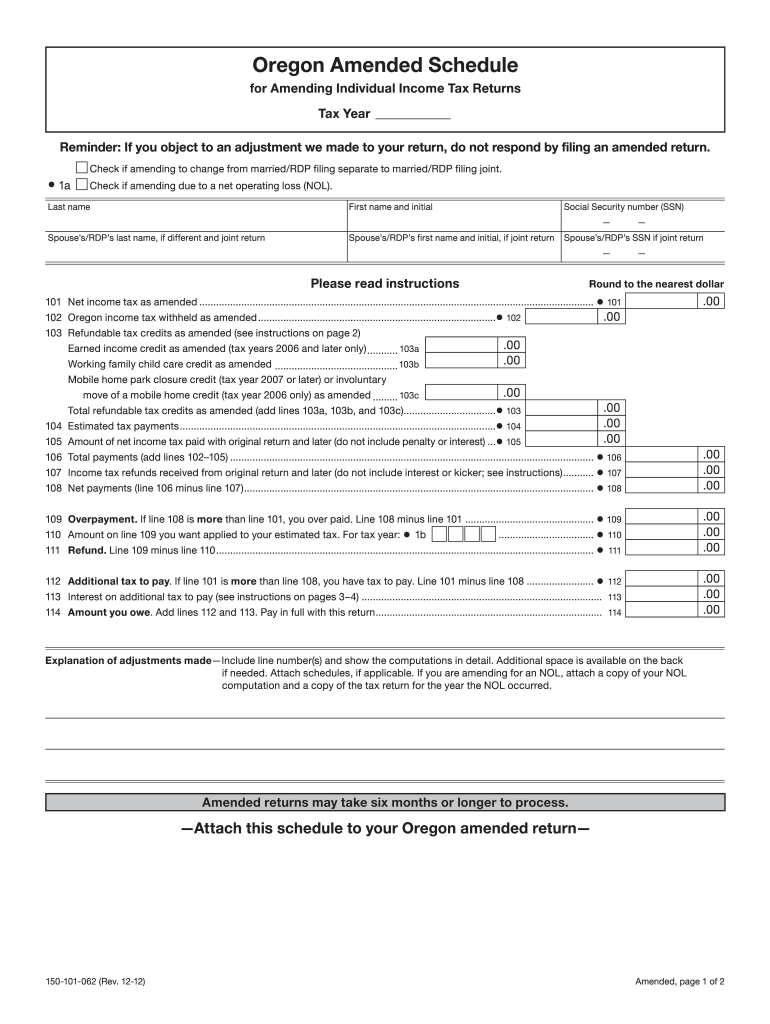

Oregon Amended Schedule 2012 Form Fill Out Sign Online Dochub

How To Transfer Your Oregon Transit Tax Information From Sage 100 To The State

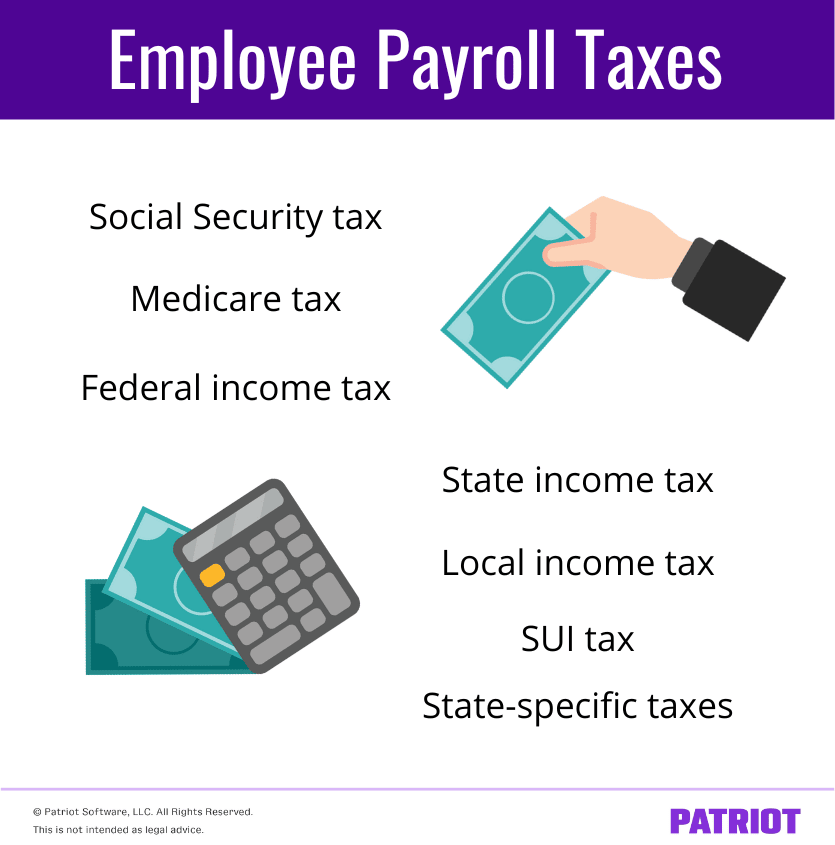

Payroll Taxes That Are The Employee S Responsibility

Oregon Labor Laws The Complete Guide For 2022

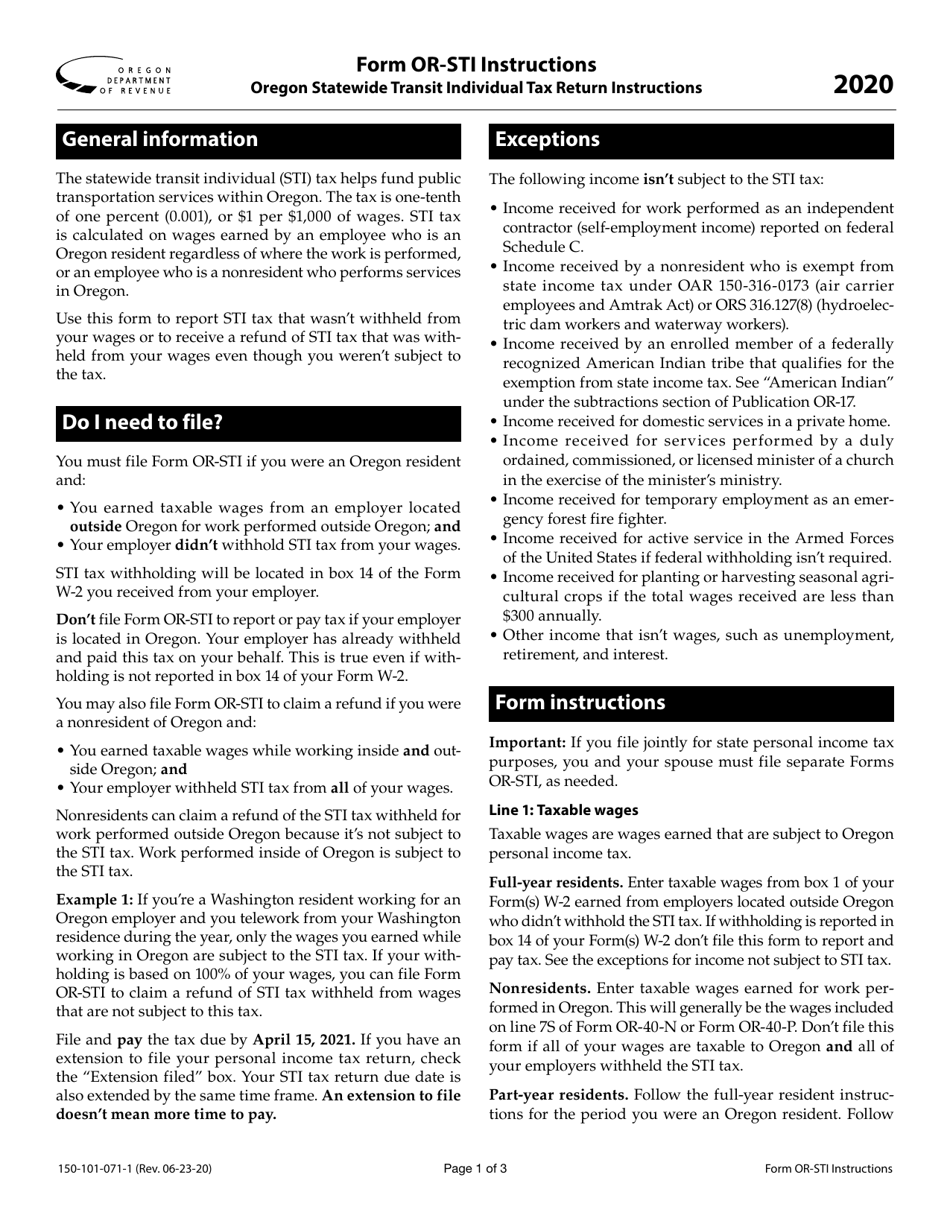

Download Instructions For Form Or Sti 150 101 071 Oregon Statewide Transit Individual Tax Return Pdf 2020 Templateroller

Payroll Systems Attn Oregon Statewide Transit Tax Effective July 1 Payroll Systems

Reporting On Oregon Statewide Transit Tax

Oregon Transit Tax Procare Support

2018 2022 Form Or Or Wr Fill Online Printable Fillable Blank Pdffiller

Payroll Systems Attn Oregon Statewide Transit Tax Effective July 1 Payroll Systems

Regional Mobility Policy Update Metro

Ezpaycheck How To Handle Oregon Statewide Transit Tax

Oregon Department Of Revenue Provides More Details About Tax Relief Oregon Association Of Tax Consultants

Form Or Stt A 150 206 001 Download Fillable Pdf Or Fill Online Oregon Annual Statewide Transit Tax Withholding Return Oregon Templateroller

The Trimet Self Employment Tax Solid State Tax Service

.jpg)